Montgomery County Draws Major REIT Investment in September

Montgomery County, Md. is known as being the anchor of the third largest biopharma hub in the nation, and a hub for technology companies, including those in quantum, defense, satellite and advanced communications. However, to some, the county may be less known as an attractive location for real estate, hospitality and non-profit companies with a global presence including JLL, Marriott, and the Good Will Foundation.

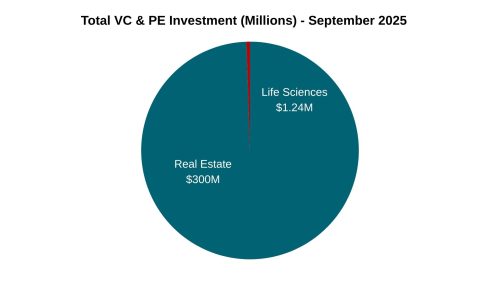

As we continue to monitor venture capital and private equity investment activity in the county, a recent $300M REITS investment demonstrates the diverse business ecosystem here. In September, AGNC Investment, a real estate investment trust (REIT) based in Bethesda, raised $300 million in its second public offering on the Nasdaq Stock Exchange. With 53 employees, AGNC Investment invests in agency residential mortgage-backed securities. Though AGNC Investment’s asset portfolio is comprised of residential mortgage pass-through securities and collateralized mortgage obligations, it also invests in other types of mortgage and mortgage-related residential and commercial mortgage-backed securities.

Another notable deal in September includes SurgiQuality, a Rockville-based health tech company that raised $1.24 million of equity crowdfunding. SurgiQuality’s healthcare platform connects surgical patients with qualified surgeons by helping users gather medical records and imaging information, and sending it to qualified surgeons of their choice, enabling patients to select surgeons based on their budget and safeguard against unnecessary surgeries.

These recent investments underscore the diversity of Montgomery County’s economy and the county’s continued attractiveness to businesses across a wide range of industries. Whether in life sciences, technology, real estate, or healthcare, Montgomery County remains a place where innovation thrives, and businesses of every size can grow and scale.